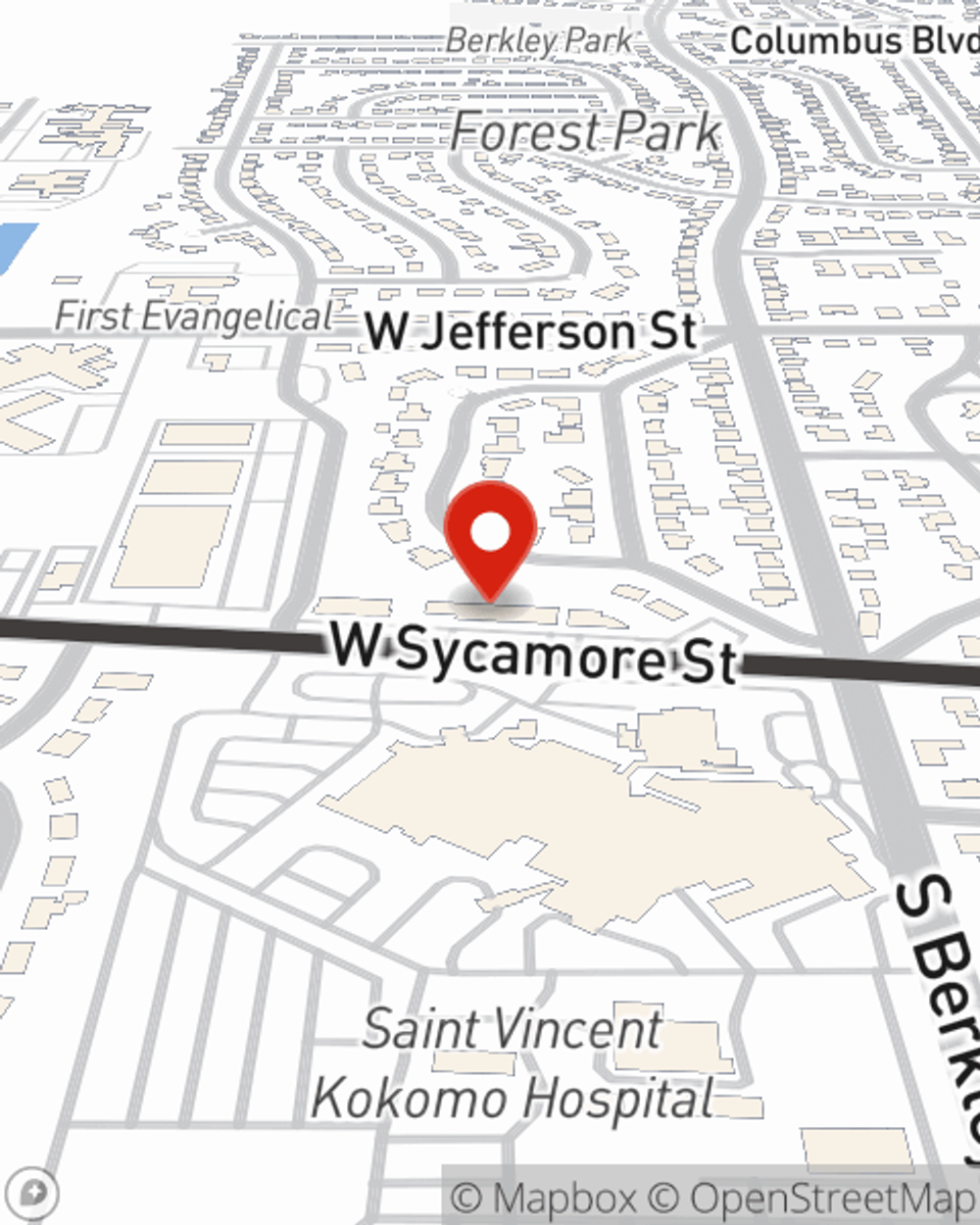

Life Insurance in and around Kokomo

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

Can you guess the price of a typical funeral? Most people aren't aware that the standard cost of a funeral in this day and age is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot meet that need, they may be unable to make ends meet in the wake of your passing. With a life insurance policy from State Farm, your family can live comfortably, even without your income. Whether it keeps paying for your home, maintains a current standard of living or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Wondering If You're Too Young For Life Insurance?

Some of your options with State Farm include coverage for a specific time frame or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent Kelly Warden's wonderful customer service is what makes Kelly Warden a great asset in helping you opt for the right policy.

Simply call or email State Farm agent Kelly Warden's office today to explore how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Kelly at (765) 450-6252 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Kelly Warden

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.